NPS, SURVEYS AND ISHOKU-HADA

WHAT CAN CX LEARN FROM...

SURPRISING INSIGHTS BY BRINGING IN OFF-BEAT CASES

SURPRISING INSIGHTS BY BRINGING IN OFF-BEAT CASES

LONG READ

NPS, SURVEYS AND ISHOKU-HADA

DO YOU KNOW ME AT ALL?

It’s the bare essential of what a survey is about. And it often gets overlooked. The heart, the promise and meaning of a survey is that you are reaching out. Not perse to ask feedback on what you can do better, or acknowledgement where you deliver on your promise. But to recognize the customer’s importance to you. Showing you know them and care about them.

With this in mind, reality is cringing. Companies are blaming low response rates on ‘survey fatigue’. The audience has so-called been overwhelmed by surveys and do not care to fill them out any longer. The knee-jerk reaction is to send out more surveys, because of course companies do need statistically significant response volumes. Sounds familiar?

And it is anything but true. It is the companies themselves to blame. They seem to ignore a cardinal rule: is it genuine? Do you really care about me? Do you know me at all? Unfortunately the answer is: no. Companies are sending out surveys that are one-size-fits-all and one-time-fits-all. And virtually all lack action. Any feedback apart from the scores seems to be ignored. Or, at the very least companies are not sending any response to it.

That is not genuinely being interested in someone. Instead, it is baiting customers to be one of the scores needed to quantify performance.

People instinctively recognise when they’re baited by bad surveys. They’re a number, needed for a number.

Let’s side-step for a moment and visit Japan. I’ve always been enamoured by Japanese culture that is at once beautiful, innovative, traditional, modern, eccentric and sometimes downright mystifying and strange. One of the truly fascinating aspects for me is how deeply the visual aspect of communication is steeped in daily life.

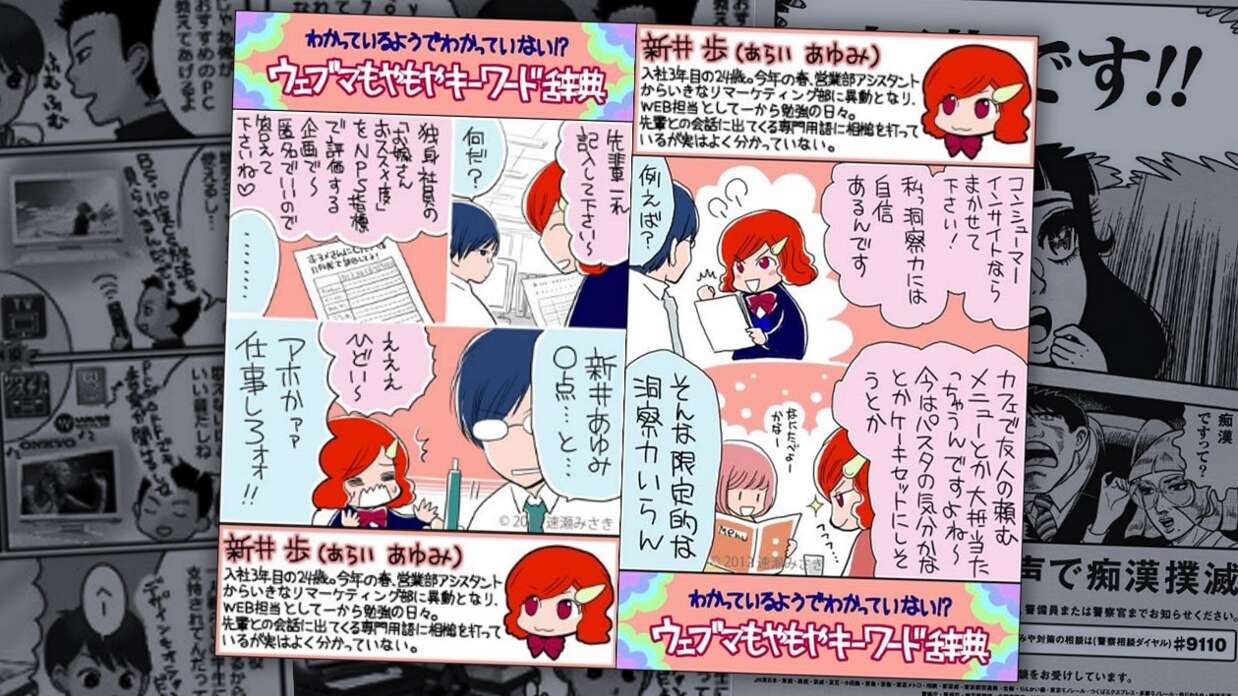

The Japanese style for business communication is unique, and borrows from graphic novels like manga and anime (which in turn are based on a long history of Japanese art), games and other pop culture. See for instance an explanation I found of how NPS works (you can see the picture top right in the header). You wouldn’t find it anywhere else in the world.

As communication goes, this explanation or brochure is designed by a company and is aimed at their customers. But let’s change direction and look at fashion, as that is how consumers express themselves to others… including companies (if they’re smart to recognise). And when it comes to fashion, the streets of Tokyo are filled with spectacular fashion statements.

Gyaru is a Japanese fashion subculture (the term is a transliteration of the English slang word ‘gal’), It is an umbrella term for a astonishing variety of styles, substyles, sub-substyles and micro-styles. With names like Ganguro, Manba and Kogyaru and many more, every single one has its own unique design, make-up, costumes, accessories and devout following. It’s just mindblowing.

From artificial deep tanned skin, glitter and bleached hair (Ganguro) to the overtly sexy outfits and elaborate, colourful dresses with bouffant hairstyles (Manba) to one you actually might recognize from pictures you’ve seen, the obsessive dressing up in Japanese school uniforms (Kogyaru).

It’s a mystifying world, and I’m hooked.

The one that I especially like is Ishoku-hada. It is eye-candy to the extreme. The name translates as “unique skin” or “unusual skin”. It is as if the participant has physically dipped herself in colourful paint. In an interview the creator of this style, model and DJ Miyako Akane, stated she ‘longed for the interesting skin tones seen in video-games, anime, movies and the idea of extraterrestrial life’. But, on a deeper level she makes a compelling statement against stereotyping, race, beliefs and prejudices. In her words: ‘by changing our skin colour or painting it, we get to liberate ourselves. It is therapy through make-up.’

And now, you are sending these Ishoku-hada players your boring and one-size-fits-all corporate survey. Let that sink in…

Yes, this is abrupt haul back to the topic of sending out surveys. Intentionally so. If you’ve been as intrigued and drawn in this other world as I am, it makes reality all the more jarring. How can a survey that is designed to appeal to e-ve-ry-one ever resonate with this group?

Of course, you can argue you don’t need to appeal to this specific group. I mean, chances are that your company would not have this Japanese subculture as customers. But that is not the point. I’m highlighting this specific group because they are so easy to highlight. With their strangeness, other-worldliness, dedication and beauty it is easy to recognise them. And therefore easy to remember.

They serve as a reminder for any group you have in your customerbase. because there are loads of groups that you do not reach with the standard questions of a standard survey. It doesn’t appeal, isn’t relevant, and it shows a startling lack of understanding. Yet remember, they are your customers.

It’s for this very reason that in the NPS Masterclass there’s an entire module dedicated to surveys. The concept, the promise, the design, but especially the endless possibilities to create more resonating and meaningful interactions. To steer away from analyses terror.

In other words, stubbornly sending out your one-size-fits-all surveys is not only getting you low-quality responses (if at all), but even worse: it is damaging the relationship with your customers. It’s excrutiatingly obvious you can’t be bothered to know or understand even the slightest bit of who they are and what they deem important. They’re just a number to you.

Paradoxically, an NPS survey is meant to gauge how loyal your customers are. Yet by sending out your stupid one-size-fits-all surveys, you trigger them leaving.

So… start regarding surveys as a means to acknowledge your customers and see it as a means to build a relationship, a conversation. That means you need to have a general base, and build in diversification.

It is really not that difficult to have one overall design for a survey that captures what you’d like to know about the customer’s experience. About some touchpoint details, and about other corporate strategy linked objectives. Keep these questions the same in every survey so can compare. But, leave room to then design different sets of questions, or just to use different wordings. As long as they are specifically targeted to a few different groups that you have identified as valuable.

This might (trust me, it will) take you a proper fight within the organisation to realise.

You’ll face colleagues that live by the notion that every single question or data point should be comparable across every single customer segment. From an analytical point of view, sure. But is quantifying every single detail really worth shattering your brand promise and alienating customers by serving up something bland and unappealing?

Instead, you argue for bringing in specific questions aimed at specific group, with the aim to specifically understand them properly. Asking them questions that are uniquely relevant to them. And allowing you to act and design improvements for that (valuable) group alone.

It will give you feedback of the highest quality. And it establishes you as a company that understands these specific customers. You know who they are. You speak their language. You share and cater to their interests. So go all out and use the right vocabulary and tone.

Is an important segment of your customer base keen on street language? Adopt it and include for example ‘dude’, ‘GOAT’ or whatever is right. Adopt the formal terminology of lawyers’ idiom if your product or service serves lawfirms. Or in case you’re tapping into the lucrative culinairy consumer segment, embrace the foodie jargon like ‘braising’, ‘deglazing’ or ‘zest’. Words foreign for most, but immediately show you are part of the in-crowd for the people that you are addressing.

And partner up for it. Co-create with the customer segment you’re addressing to find out what communication style to use, because you don’t want to get this wrong. By the way, this is also a fantastic way to bond with this group.

From a functional, numerical. bland one-size-fits-all survey that customers are wary of.., to surveys that resonate, that cherish and establish a relationship. A conversation, with someone you know.

It just needs a change of mindset of what a survey actually is.

LONG READ

NPS, SURVEYS AND ISHOKU-HADA

DO YOU KNOW ME AT ALL?

It’s the bare essential of what a survey is about. And it often gets overlooked. The heart, the promise and meaning of a survey is that you are reaching out. Not perse to ask feedback on what you can do better, or acknowledgement where you deliver on your promise. But to recognize the customer’s importance to you. Showing you know them and care about them.

With this in mind, reality is cringing. Companies are blaming low response rates on ‘survey fatigue’. The audience has so-called been overwhelmed by surveys and do not care to fill them out any longer. The knee-jerk reaction is to send out more surveys, because of course companies do need statistically significant response volumes. Sounds familiar?

And it is anything but true. It is the companies themselves to blame. They seem to ignore a cardinal rule: is it genuine? Do you really care about me? Do you know me at all? Unfortunately the answer is: no. Companies are sending out surveys that are one-size-fits-all and one-time-fits-all. And virtually all lack action. Any feedback apart from the scores seems to be ignored. Or, at the very least companies are not sending any response to it.

That is not genuinely being interested in someone. Instead, it is baiting customers to be one of the scores needed to quantify performance.

People instinctively recognise when they’re baited by bad surveys. They’re a number, needed for a number.

Let’s side-step for a moment and visit Japan. I’ve always been enamoured by Japanese culture that is at once beautiful, innovative, traditional, modern, eccentric and sometimes downright mystifying and strange. One of the truly fascinating aspects for me is how deeply the visual aspect of communication is steeped in daily life.

The Japanese style for business communication is unique, and borrows from graphic novels like manga and anime (which in turn are based on a long history of Japanese art), games and other pop culture. See for instance an explanation I found of how NPS works (you can see the picture top right in the header). You wouldn’t find it anywhere else in the world.

As communication goes, this explanation or brochure is designed by a company and is aimed at their customers. But let’s change direction and look at fashion, as that is how consumers express themselves to others… including companies (if they’re smart to recognise). And when it comes to fashion, the streets of Tokyo are filled with spectacular fashion statements.

Gyaru is a Japanese fashion subculture (the term is a transliteration of the English slang word ‘gal’), It is an umbrella term for a astonishing variety of styles, substyles, sub-substyles and micro-styles. With names like Ganguro, Manba and Kogyaru and many more, every single one has its own unique design, make-up, costumes, accessories and devout following. It’s just mindblowing.

From artificial deep tanned skin, glitter and bleached hair (Ganguro) to the overtly sexy outfits and elaborate, colourful dresses with bouffant hairstyles (Manba) to one you actually might recognize from pictures you’ve seen, the obsessive dressing up in Japanese school uniforms (Kogyaru).

It’s a mystifying world, and I’m hooked.

The one that I especially like is Ishoku-hada. It is eye-candy to the extreme. The name translates as “unique skin” or “unusual skin”. It is as if the participant has physically dipped herself in colourful paint. In an interview the creator of this style, model and DJ Miyako Akane, stated she ‘longed for the interesting skin tones seen in video-games, anime, movies and the idea of extraterrestrial life’. But, on a deeper level she makes a compelling statement against stereotyping, race, beliefs and prejudices. In her words: ‘by changing our skin colour or painting it, we get to liberate ourselves. It is therapy through make-up.’

And now, you are sending these Ishoku-hada players your boring and one-size-fits-all corporate survey. Let that sink in…

Yes, this is abrupt haul back to the topic of sending out surveys. Intentionally so. If you’ve been as intrigued and drawn in this other world as I am, it makes reality all the more jarring. How can a survey that is designed to appeal to e-ve-ry-one ever resonate with this group?

Of course, you can argue you don’t need to appeal to this specific group. I mean, chances are that your company would not have this Japanese subculture as customers. But that is not the point. I’m highlighting this specific group because they are so easy to highlight. With their strangeness, other-worldliness, dedication and beauty it is easy to recognise them. And therefore easy to remember.

They serve as a reminder for any group you have in your customerbase. because there are loads of groups that you do not reach with the standard questions of a standard survey. It doesn’t appeal, isn’t relevant, and it shows a startling lack of understanding. Yet remember, they are your customers.

It’s for this very reason that in the NPS Masterclass there’s an entire module dedicated to surveys. The concept, the promise, the design, but especially the endless possibilities to create more resonating and meaningful interactions. To steer away from analyses terror.

In other words, stubbornly sending out your one-size-fits-all surveys is not only getting you low-quality responses (if at all), but even worse: it is damaging the relationship with your customers. It’s excrutiatingly obvious you can’t be bothered to know or understand even the slightest bit of who they are and what they deem important. They’re just a number to you.

Paradoxically, an NPS survey is meant to gauge how loyal your customers are. Yet by sending out your stupid one-size-fits-all surveys, you trigger them leaving.

So… start regarding surveys as a means to acknowledge your customers and see it as a means to build a relationship, a conversation. That means you need to have a general base, and build in diversification.

It is really not that difficult to have one overall design for a survey that captures what you’d like to know about the customer’s experience. About some touchpoint details, and about other corporate strategy linked objectives. Keep these questions the same in every survey so can compare. But, leave room to then design different sets of questions, or just to use different wordings. As long as they are specifically targeted to a few different groups that you have identified as valuable.

This might (trust me, it will) take you a proper fight within the organisation to realise.

You’ll face colleagues that live by the notion that every single question or data point should be comparable across every single customer segment. From an analytical point of view, sure. But is quantifying every single detail really worth shattering your brand promise and alienating customers by serving up something bland and unappealing?

Instead, you argue for bringing in specific questions aimed at specific group, with the aim to specifically understand them properly. Asking them questions that are uniquely relevant to them. And allowing you to act and design improvements for that (valuable) group alone.

It will give you feedback of the highest quality. And it establishes you as a company that understands these specific customers. You know who they are. You speak their language. You share and cater to their interests. So go all out and use the right vocabulary and tone.

Is an important segment of your customer base keen on street language? Adopt it and include for example ‘dude’, ‘GOAT’ or whatever is right. Adopt the formal terminology of lawyers’ idiom if your product or service serves lawfirms. Or in case you’re tapping into the lucrative culinairy consumer segment, embrace the foodie jargon like ‘braising’, ‘deglazing’ or ‘zest’. Words foreign for most, but immediately show you are part of the in-crowd for the people that you are addressing.

And partner up for it. Co-create with the customer segment you’re addressing to find out what communication style to use, because you don’t want to get this wrong. By the way, this is also a fantastic way to bond with this group.

From a functional, numerical. bland one-size-fits-all survey that customers are wary of.., to surveys that resonate, that cherish and establish a relationship. A conversation, with someone you know.

It just needs a change of mindset of what a survey actually is.